utah state solar tax credit 2019

For solar PV systems the maximum credit decreases over time as follows. Everyone in Utah is eligible to take a personal tax credit when installing solar panels.

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

But that sun also makes Utah an ideal state for solar energy development.

. Is a post-performance non. The Utah solar tax credit allows you to claim up to 25 percent of your total home PV system and installation costs or 2000. Utah Governor Gary Herbert signed a new bill into law SB 141 that grants an extension to the states solar tax credit.

If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar costs. Additional residential energy systems or parts may be claimed in following years as long as the total amount claimed does not. Before 12312018 - 1600.

Taxpayers wishing to use this tax credit must first apply through the Utah State Energy Program before claiming the tax credit against their Utah state taxes. In the TurboTax Utah interview get to the screen titled Lets Check for Utah Credits Page 2 of 2. Rooftop solar installations are eligible for a 30 federal tax credit and a 25 state tax credit capped at.

2017 Is the Last Year for the Maximum State Tax Credit. Utah customers may also qualify for a state tax credit in addition to the federal credit. In 2021 the ITC will provide a 26 tax credit for systems installed between 2020 and 2022 and 22 for systems installed in 2023.

The federal solar tax credit also known as the solar investment tax credit or ITC offers new solar owners in the United States a tax credit equal to 26 of costs they paid for. So when youre deciding on whether or not to. The Utah State Tax Commission offers a tax credit for renewable energy systems including solar.

The federal tax credit offers 30 percent back on residential installations so together these can reduce the cost of. By Tracy Fosterling on Mar 28 2018. Renewable Residential Energy Systems Credit code 21 Utah Code 59-10-1014.

This credit is for reasonable costs including installation of a residential energy system that supplies energy to a Utah residential unit. Solar Energy Systems Phase-out. In fact you should claim both the state and federal solar ITC.

You can claim 25 percent. Under the Amount column write in 2000 a. To enter it in TurboTax please see the instructions below.

The bill extends the cap on the. And because of the climate it is among the sunniest states in the countrys solar belt. Utahs solar tax credit currently is frozen at 1600 but it wont be for long.

This amount decreases by 400 each year after until it expires. QUALIFYING FOR THE UTAH SOLAR TAX CREDIT. The tax credit for a residential system is 25 of the purchase and installation costs up to a maximum.

Federal tax credit its technically called the Investment Tax Credit. 2000 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit. All of our customers with a taxable income qualify for the US.

In addition to the solar rebates that are available Utah offers solar tax credits in the form of 25 of the purchase and installation costs of a solar system up to 2000. Starting in 2021 it will resume its yearly phase down until this tax credit reaches zero at the. In that list is.

FDIC Premium Deduction. For systems installed before 12312017 the maximum credit is 2000. This form is provided by the Utah Housing Corporation if you qualify.

The credit amounts to 25 of the total system costs up to a maximum of. The maximum Re-newable Residential Energy Systems Credit credit 21 for solar power systems installed in 2019 is 1600. From 2018 to 2021 the maximum credit available for residential solar PV is 25 of eligible costs or 1600 whichever is lower.

State Low-income Housing Tax Credit Allocation Certification.

Solar Incentives In Utah Utah Energy Hub

Solar Tax Credit Details H R Block

Can I Claim The Federal Solar Tax Credit For Roof Replacement Costs Westfall Roofing Tampa Sarasota

How Net Metering Is Evolving Three Changes You Need To Know Aurora Solar

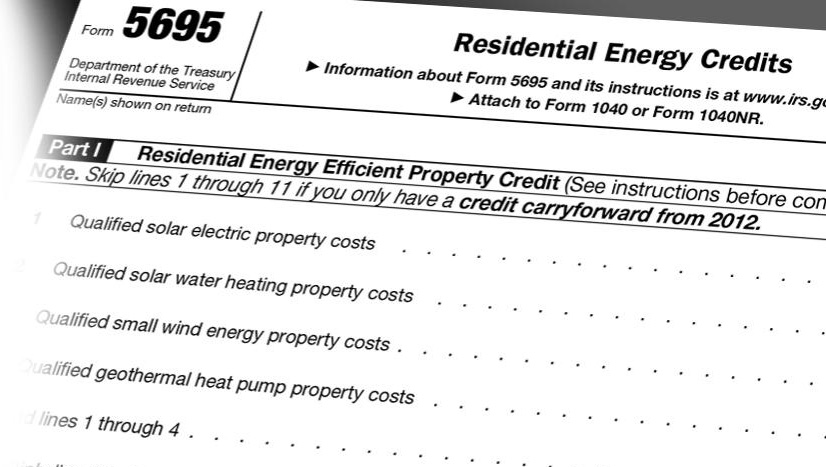

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Solar Panel Installation Tax Credits Intermountain Wind Solar

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun

Tax Credit Info Daylighting Systems Solar Powered Fans Solatube

Understanding The Utah Solar Tax Credit Ion Solar

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions

2019 Pennsylvania Home Solar Incentives Rebates And Tax Credits Tax Credits Incentive Pennsylvania

2019 Pennsylvania Home Solar Incentives Rebates And Tax Credits Tax Credits Incentive Pennsylvania

Groups Selected For Nyserda S Clean Energy Integration Challenge Lắp đặt điện Mặt Trời Hcm Khải Minh T Energy Research Future Energy Renewable Energy Resources

Federal Solar Tax Credit Savings 2020 Vs 2021 Energysage

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Why The Solar Tax Credit Extension Is A Big Deal In 2020 Energysage

How Net Metering Is Evolving Three Changes You Need To Know Aurora Solar